Comprehensive Guide to low-income senior housing

Finding affordable housing as a senior can be a challenging process, especially for individuals relying solely on fixed income sources such as Social Security or small pensions. Fortunately, various Government-supported low-income senior housing options exist to meet these needs. This guide explores how to find senior housing based on income, outlines the application steps, and provides real-life examples to demonstrate how others have successfully navigated the system.

What government-supported projects and programs are available to you?

1. HUD Subsidized Housing: Is Section 202 Right for You?

Section 202 Supportive Housing for the Elderly: This program, administered by the Department of Housing and Urban Development (HUD), provides apartments to low-income seniors. Beyond affordable rent, it offers essential services like cleaning, transportation, and meal preparation, facilitating a supportive living environment. This can be particularly beneficial for seniors who need extra help with daily tasks, offering a blend of independence and necessary assistance.

2. Public Housing: Could This Be Your New Community?

Managed by local Public Housing Agencies (PHAs), public housing offers affordable rental accommodations with rates adjusted to the resident's income. These settings are often tailored for senior living, promoting community connections and providing localized support services.

3. Housing Choice Voucher Program (Section 8): How Can It Benefit You?

This program offers vouchers for renting on the private market, aligning subsidized rent with your income. The flexibility allows seniors to choose where they live, maintaining autonomy and access to desired amenities and services.

4. Low-Income Housing Tax Credit (LIHTC) Properties: Are These a Good Fit?

As Emma discovered, LIHTC properties provide rent reductions through incentives for developers. These properties cater to a variety of lifestyle preferences and needs, offering a cost-effective solution in diverse community environments.

Non-profit and Charitable Organizations: Have You Explored All Avenues?

Beyond government programs, numerous organizations focus on senior housing, often complementing housing with support services. Options vary by location but can be an invaluable resource.

How does government-supported low-income housing help seniors?

Learn how others have successfully used these resources to obtain housing for seniors 65 and older:

Beneficiary 1: Mary’s Experience with Section 202 Supportive Housing for the Elderly

Mary, a 65-year-old widow, was living on a fixed income from Social Security after retiring as a school librarian. Her rising rental costs prompted her to seek affordable housing. She found that her income fell well below 50% of the Area Median Income (AMI), qualifying her for Section 202 Supportive Housing for the Elderly. This program matched her needs, given her age and requirement for supportive services. After contacting her local Public Housing Agency and providing necessary documentation, Mary was placed on a waiting list. She eventually secured an apartment that provided services like housekeeping and transportation, relieving her financial stress and improving access to community support and healthcare.

Beneficiary 2: Emma’s Path to Low-Income Housing Tax Credit Property

Emma, a 62-year-old artist with fluctuating income, needed stable housing as her savings fell short of covering rising rents. Qualifying for Low-Income Housing Tax Credit (LIHTC) properties by earning below 80% of the AMI, Emma provided financial documentation to demonstrate her need. Within months, she moved into an LIHTC apartment that was not only affordable but also part of a vibrant community of artists and seniors. This allowed her to better allocate her limited income towards healthcare while maintaining her artistic pursuits.

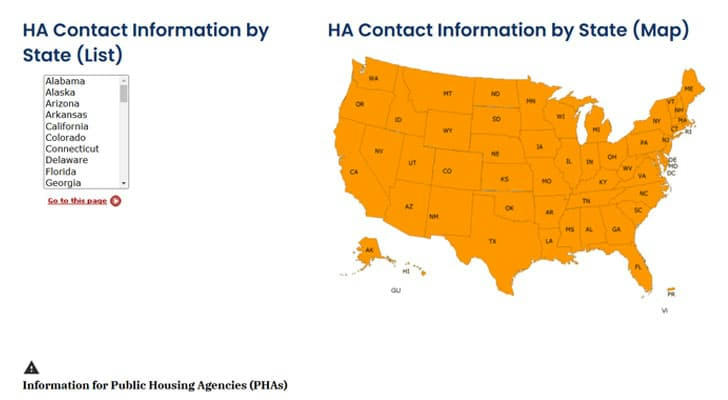

Whether you are looking for low-income senior housing in Florida or affordable housing for the elderly in California, you can find the information you need through the state HA contact information (list).

How Do You Qualify for Senior Housing?

Understanding eligibility criteria is a crucial first step toward securing your new home.You can search and find [Housing for Seniors on Social Security], [Government-supported low-income senior housing], or [Housing for 65 and Older] on the official website to get information.

1. Are You of Eligible Age?

Typically, you need to be at least 62 years old to qualify, though some programs accept seniors starting at 55.

2. Is Your Income Within the Limits?

Income should generally fall between 50% and 80% of the area’s median, but these figures change annually, so staying updated is essential.

3. Does Your Residency or Citizenship Qualify?

U.S. citizenship or eligible immigration status is required. Some programs also mandate local residency.

4. Do You Have a Clean Background?

Background checks, involving rental and sometimes criminal history, ensure community safety.

5. Are Your Documents Ready?

Preparing documents such as proof of income, age, and residency early can streamline the application process.

The Application Process

Government-supported low-income senior housing application process

After determining eligibility, here’s how to apply effectively:

1. Contact Local Public Housing Agencies (PHAs)

Initiate contact with your local Public Housing Agency to discuss available options and application procedures. Mary’s journey began with a simple call that led to the supportive housing she enjoys today.

2. Use the HUD Website

The HUD website serves as a comprehensive tool for finding HUD-approved properties and program specifics, aiding informed decision-making.

3. Complete the Application Thoroughly

Ensure application completeness and accuracy, keeping a systematic record of submissions due to potential wait periods.

4. Prepare Supporting Documents

Organized document preparation spares stress, Emma skillfully used this strategy on her way to success.

Disclaimer: This guide provides only general information, which may vary depending on your specific circumstances. Program details, eligibility requirements, and availability may vary by state and individual circumstances.